Life & Health Reinsurance:

We specialize in providing innovative life and health reinsurance solutions tailored to meet the evolving needs of cedents (insurers). Our comprehensive offerings include treaty and facultative reinsurance solutions designed to optimize risk management thereby enhancing predictability and profitability.

Travel Reinsurance:

We tailor our travel reinsurance solutions to meet the unique needs of our insurers. Whether it's loss of baggage, emergency medical condition, trip cancellation or any other customised solution to fit your specific requirements, our comprehensive reinsurance programs are designed to manage and mitigate risk efficiently.

Underwriting

Our cedents have the advantage of benefitting from the vast depth of our underwriting expertise.

We provide:-

- Impeccable medical and financial underwriting decisions based on our risk assessment

- Automated underwriting solutions for individual life insurance, and pricing tool for group life insurance

- Facultative placement and underwriting review

- Training programs for clients’ underwriting team

- Audit of clients' underwriting process and auto accepted risks

- Commitment to a quick turnaround time

- Easy accessibility to our underwriting team and unmatched level of expertise for all your underwriting needs

Value added services:

-

- The Value Added Services (VAS) strategic initiative aims to maintain an end-to-end long term insurance portfolio for our cedents along with a full-fledged reinsurance administration system and solutions as part of our reinsurance services. This is a unique model crafted by HDFC International Life and Re for its’ cedents. The VAS model helps to further fortify our association with our cedents and provides an opportunity to build a new line of business without the worries and trappings of system overheads. Also, as a risk-carrier, introduction of this strategic model allows us to hedge our risk portfolio depending on the geographies we choose to operate.

- The VAS model offers a suite of solutions, tailor-made to suit the demands of our insurers and partners. We also support exclusive and secure multi-tenant instances with multi-currency capabilities across geographies. Our comprehensive Partner ecosystem is thus a fully automated, dedicated digital space for our partners, enabling them to go digital mobile on day zero.

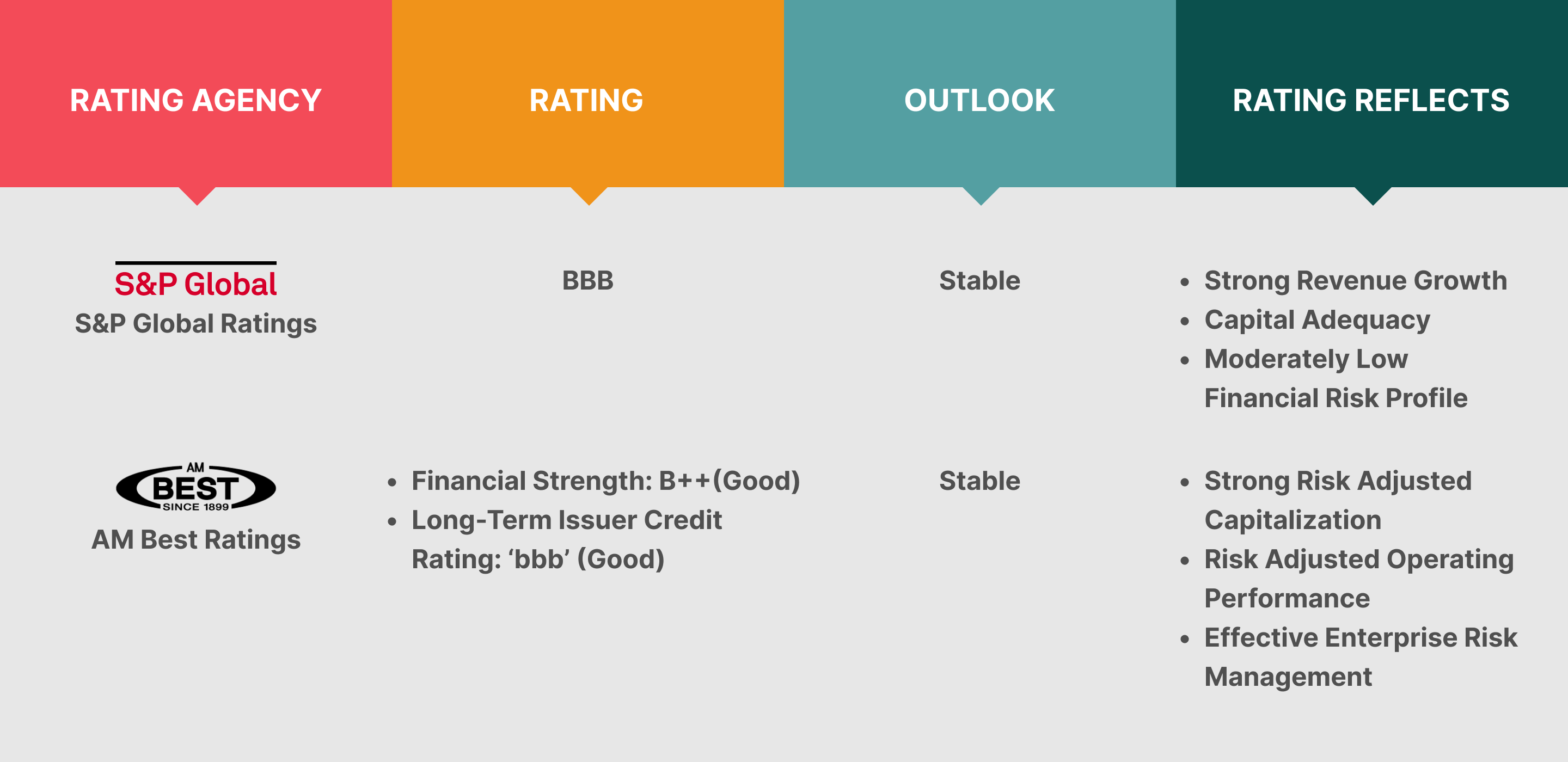

Financial Strength Rating and Long-Term Issuer Credit Rating